Ý kiến:1 创始人: Site Editor Publish Time: 2025-04-24 Origin: Trang chủ

With the rapid development of information

technology and the growth of data centers' demand for high-speed,

high-efficiency and low-energy data transmission, the optical chip market has

huge potential and broad application space. As one of the key components of

optical devices, domestic optical chip manufacturers have been attacking cities

in recent years and have made great progress in many subdivided product fields.

First, the industrial chain

The upstream of China's optical chip

industry chain includes raw materials and equipment, including indium phosphide

substrate materials, gallium arsenide substrate materials, industrial gases,

packaging materials, metal targets, etc., and equipment including lithography

machines, etching machines, epitaxial equipment, etc., etc. The midstream is an

optical chip, which can be divided into a laser chip and a detector chip;

Downstream applications are in optical communications, consumer electronics,

automotive electronics, industrial manufacturing, medical and other fields.

2. Upstream analysis

1. Industrial gases

(1) Market size

Since the beginning of the 21st century,

China's industrial market has developed rapidly, the demand for products has

grown, and China has gradually become one of the most active markets in the

global industrial gas industry, bringing historic development opportunities to

the gas industry, and the market scale has grown significantly. According to

the "2024-2029 China Industrial Gas Industry Development Prospect and

Investment and Financing Strategy Research Report" released by the China

Business Industry Research Institute, the scale of China's industrial gas

market will be about 196.4 billion yuan in 2022, a year-on-year increase of

9.23%, and about 212.9 billion yuan in 2023. Analysts at the China Business

Industry Research Institute predict that the size of China's industrial gas

market will reach 229.5 billion yuan in 2024.

<!--[if gte vml 1]>

Data source: China Commercial Industry

Research Institute

(2) Analysis of key enterprises

The key enterprises in the industrial gas

industry mainly include Jinhong Gas, Kaimei Special Gas, Huate Gas, Zhengfan

Technology, Heyuan Gas, Qiaoyuan Co., Ltd., CSSC Special Gas, Chendian

International, etc.

<!--[if gte vml 1]>

Source: Compiled by China Business Industry

Research Institute

2. Encapsulation material

(1) Encapsulation substrate

The packaging substrate can provide

electrical connection, protection, support, heat dissipation, assembly and

other functions for the chip, so as to achieve the purpose of multi-pining,

reducing the volume of the packaged product, improving electrical performance

and heat dissipation, and ultra-high density or multi-chip modularization. The

key enterprises are shown in the figure:

<!--[if gte vml 1]>

Source: Prismark, China Business Industry

Research Institute

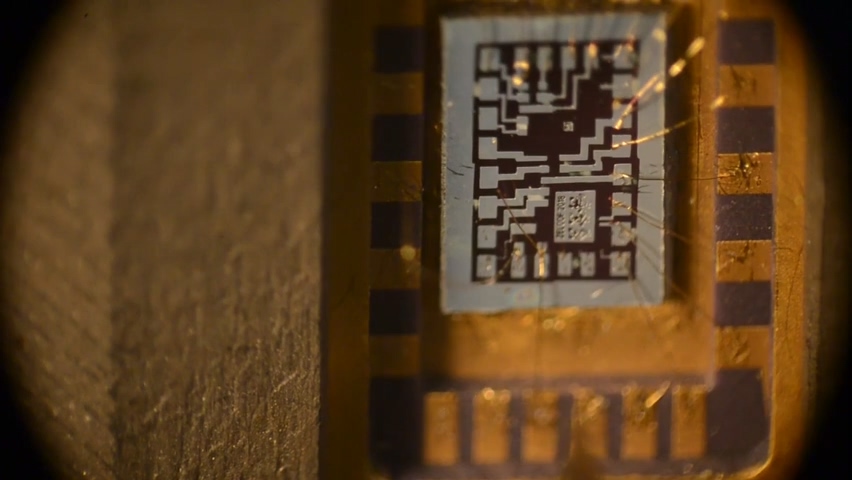

(2) Bonding wire

Bonding wire is a tiny metal wire with a

diameter of tens of microns to tens of microns that realizes the electrical

connection between the input and output connection points of the circuit in the

chip and the internal contact points of the lead frame. According to different

materials, it is divided into non-alloy wire and alloy wire, and non-alloy wire

includes gold wire, silver wire, copper wire and aluminum wire; Alloy wires

include gold-plated silver wires and copper-plated bonding wires.

China's bonding wire market is mainly

occupied by German, South Korean, and Japanese manufacturers, and the products

of local manufacturers are relatively single or low-end. Key companies include

Heraeus, Mingkaiyi, Nippon Steel, Tanaka, Yinuo Electronics, Wanshenghe,

Noferkin and so on.

<!--[if gte vml 1]>

Source: Compiled by China Business Industry

Research Institute

3. Lithography machine

(1) Global market size

In recent years, in the case of relatively

sluggish demand for consumer electronics, new demand such as electric vehicles,

wind and solar energy storage, and artificial intelligence have become new

driving forces for the growth of the semiconductor industry, and the global

lithography machine market has grown steadily. According to the data released

by SEMI, the global semiconductor equipment market size in 2022 will be 107.65

billion US dollars, of which the lithography machine market will account for about

24%, reaching about 25.84 billion US dollars, and about 27.13 billion US

dollars in 2023. Analysts at the China Business Industry Research Institute

predict that the global lithography machine market will increase to $31.5

billion in 2024.

<!--[if gte vml 1]>

Data source: SEMI, China Commercial

Industry Research Institute

(2) Competitive landscape

The lithography machine market presents an

oligopoly pattern, with the top three suppliers (ASML in the Netherlands, Canon

in Japan, and Nikon in Japan) accounting for the vast majority of the market

share, of which ASML accounts for 82.1% of the market share, Canon accounts for

10.2% of the market share, and Nikon accounts for 7.7% of the market share.

Among domestic enterprises, Shanghai Microelectronics is currently the first

and only lithography machine giant in China, with chip manufacturing capacity

of 90nm and below. According to public data, Shanghai microelectronics

lithography machine shipments have previously accounted for more than 80% of

the domestic market share.

<!--[if gte vml 1]> <!--[endif]-->

<!--[endif]-->

Data source: China Commercial Industry

Research Institute

4. Etching machine

(1) Global market size

According to the "2024-2029 Global

Etching Machine Market Prospect and Investment Opportunity Research

Report" released by the China Business Industry Research Institute, the

global etching equipment market will reach US$13.99 billion in 2022, a

year-on-year increase of 6.3%, and about US$14.82 billion in 2023. Driven by

the vigorous development of the terminal application market and the upgrading

of semiconductor manufacturing technology, analysts at the China Commercial

Industry Research Institute predict that the global etching equipment market

will grow to $15.18 billion in 2024.

<!--[if gte vml 1]>

Data source: China Commercial Industry

Research Institute

(2) Analysis of key enterprises

The main manufacturers of etching machines

in China include North Huachuang, China Micro Corporation, China Electronics

Technology, Beijing Chuangshi Weiner Technology, Yitang Semiconductor, Beijing

Jinsheng Micro-Nano Technology and Shiyuan.

<!--[if gte vml 1]>

Source: Compiled by China Business Industry

Research Institute

3. Midstream analysis

1. Global optical chip market size

The optical chip market is currently in a

stage of rapid development, with the continuous advancement of global

informatization, the optical communication market continues to grow, bringing a

broad market space for the optical chip industry. According to LightCounting

data, the global optical chip market size will be $2.7 billion in 2022.

Analysts at the China Business Industry Research Institute predict that the

global market size is expected to grow to $5.6 billion by 2027, with a CAGR of

16%, and there is broad room for development.

<!--[if gte vml 1]>

Data source: LightCounting, compiled by

China Business Industry Research Institute

2. The size of China's optical chip

market

Thanks to the continuous advancement of the

localization of optical chips, a large number of data center equipment updates

and new data centers will continue to help the growth of the optical chip

market, and China will become one of the fastest growing regions in the world.

According to the "2024-2029 Research Report on the Development Trend and

Investment Pattern of China's Optical Chip Industry" released by the China

Business Industry Research Institute, the market size of China's optical chips

in 2022 will be about 12.484 billion yuan, a year-on-year increase of 14.83%,

and the market size will be about 13.762 billion yuan in 2023. Analysts at the

China Business Industry Research Institute predict that the size of China's

optical chip market will grow to 15.156 billion yuan in 2024.

<!--[if gte vml 1]>

Data source: China Commercial Industry

Research Institute

3. Localization rate of optical chips

Domestic related enterprises have only

mastered the core technology in the field of 2.5G and 10G optical chips, and

the localization rate of 2.5G and below optical chips has exceeded 90%; The

localization rate of 10G optical chips is about 60%; The localization rate of

optical chips of 25Gbs and above is low, only 4%.

<!--[if gte vml 1]>

Data source: ICC, China Business Industry

Research Institute

4. Competition in the optical chip

market

Domestic professional optical chip

manufacturers include Yuanjie Technology, Wuhan Minxin, Zhongke Optical Chip,

Leiguang Technology, Guanganlun, Yunling Optoelectronics, etc. Domestic

integrated optical chip module manufacturers or manufacturers with independent

optical chip business sectors include Accelink, Hisense Broadband, Source

Vision, San'an Optoelectronics, Shijia Photonics, etc. At present, domestic

optical chip companies are actively developing 25G optical chip products, and

Yuanjie Technology, Accelink Technology, Shijia Photonics, Hisense Broadband

and other enterprises have relevant business layouts.

<!--[if gte vml 1]>

Source: Compiled by China Business Industry

Research Institute

5. Analysis of key enterprises in

optical chips

At present, the number of listed companies

related to optical chips in China is small, and the number of enterprises in

Guangdong Province and Jiangsu Province is relatively large, both of which are

5. Hubei Province has a total of 4, ranking third.

<!--[if gte vml 1]>

Source: Compiled by China Business Industry

Research Institute

Fourth, downstream analysis

1. Optical communication

With the technological progress and cost

reduction of optical chips and optical devices, the optical communication

industry will be able to better cope with the huge pressure brought by the

massive data and high-speed computing requirements in the future, and the

optical communication industry is expected to maintain continuous growth.

According to the "2024-2029 China Optical Communication Industry Market

Prospect Forecast and Future Development Trend Research Report" released

by the China Business Industry Research Institute, the optical communication

market size will be about 133.1 billion yuan in 2022, a year-on-year increase

of 8.56%, and about 140.5 billion yuan in 2023. Analysts at the China Business

Industry Research Institute predict that the market size will reach 147.3

billion yuan in 2024.

<!--[if gte vml 1]>

Data source: China Commercial Industry

Research Institute

2. Consumer electronics

(1) Mobile phone

In recent years, China's mobile phone

shipments have been on a downward trend, the market is close to saturation, and

consumer demand for mobile phones is gradually weakening. According to data

from the Academy of Information and Communications Technology, in April 2024,

24.071 million mobile phones were shipped in the domestic market, a

year-on-year increase of 28.8%. From January to April 2024, the domestic market

shipped 91.486 million mobile phones, a year-on-year increase of 12.3%.

<!--[if gte vml 1]>

Data source: Compiled by the Academy of

Information and Communications Technology and the China Business Industry

Research Institute

(2) Tablet

IDC data shows that after four consecutive

quarters of decline in 2023, China's tablet market demand ushered in a slight

rebound, coupled with the pull of shipments at the beginning of the year,

market shipments ushered in positive growth in the first quarter of this year.

In the first quarter of 2024, China's tablet market shipped 7.13 million units,

a year-on-year increase of 6.6%.

<!--[if gte vml 1]>

Data source: IDC, China Commercial Industry

Research Institute

3. Automotive electronics

Affected by the boom in production and

sales of new energy vehicles, the degree of automotive electronics continues to

improve, and automotive electronics will usher in a long boom cycle. According

to the "2024-2029 China Automotive Electronics Industry Development and

Investment Strategy Research Report" released by the China Business

Industry Research Institute, the scale of China's automotive electronics market

will reach 978.3 billion yuan in 2022, a year-on-year increase of 12%, and

about 1,097.3 billion yuan in 2023. Analysts at the China Business Industry

Research Institute predict that the scale of China's automotive electronics

market will further grow to 1,158.5 billion yuan in 2024.

An ninh mạng Tô Công 3205830204438

An ninh mạng Tô Công 3205830204438